Overview

MasterCard is announcing changes to the threshold of excessive authorizations and associated fees.

Background

Through the Excessive Authorization Attempts TPE, MasterCard continuously monitors the utilization of the network and detects the excessive authorizations submitted into the network over the threshold with the sole purpose of stopping excessive attempts.

Resolution

MasterCard is reducing the threshold of declined attempts from 20 to 10 for the Excessive Authorization Attempts Transaction Processing Excellence (TPE) Program.

The Excessive Authorization Attempts TPE Program currently assesses a weekly fee for each authorization after 20 previously-declined attempts on the same card and same card acceptor ID within a 24-hour period.

Beginning October 1, 2022, to further reinforce proper processing behavior surrounding repeated declined attempts, MasterCard is reducing the threshold of declined attempts for the Excessive Authorization Attempts TPE Program from 20 to 10.

The weekly rate assessed for each authorization after 10 previously issued declined attempts on the same account will be billed at the existing rate during the remainder of 2022.

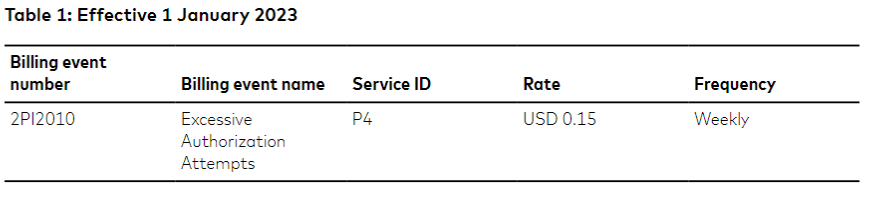

Beginning January 1, 2023, the weekly rate assessed for each authorization after 10 previously issued declined attempts on the same account will be billed in accordance with the fee schedule in the Billing and Pricing Information below:

First billing will occur on January 15, 2023.

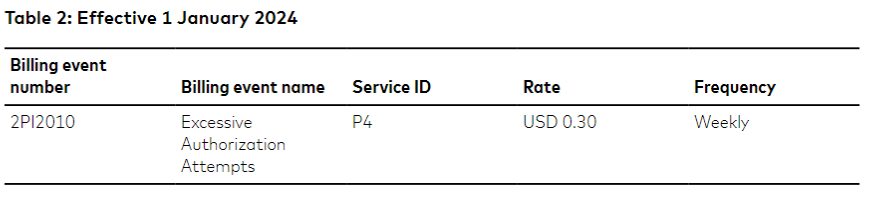

First billing will occur on January 14, 2024.

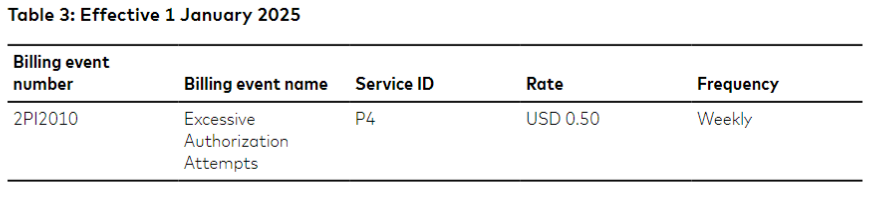

First billing will occur on January 19, 2025.

Acquirer Obligations

To avoid the TPE fees, MasterCard recommends acquirers to ensure the following occurs:

- Cease sending authorizations on the same card, the same card acceptor ID, within a 24-hour period after receiving 10 decline responses from the issuer.

- Ensure they are using the Account Status Inquiry (ASI) transaction type for account status checks.