Check and ACH Processing Overview

Paya is a leading integrated payment processing provider for electronic check and Automated Clearing House (ACH) payment processing.

Electronic payment processing is more than checks. Paya is dedicated to facilitating payments of sales tickets from your customers and funding your business through processing ACH and/or Checks to your customers’ U.S.-based financial institution.

Note: Automated Clearing House (ACH) is governed by the National Automated Clearing House Association (NACHA) the organization that manages the electronic movement of money in the U.S. Paya has unique rules to follow based on the NACHA Operating Rules & Guidelines and has compliance specialists and risk analysts on staff to help guide and assist you in understanding and following the applicable rules.

Below we have summarized some basics to help you with some best practices and tips to make your relationship with Paya successful and to protect yourself from customer payment fraud.

Payment Solutions

Paya’s solutions include converting a check to ACH (Point of Purchase) or to Check 21 (Remote Deposit Capture) along with other payment environments using a customer’s bank account.

Listed below are the programs developed by Paya for electronic payment processing, based on environments that businesses receive payments.

| Program | Customer Payment Method |

| Point of Sale Conversion, Paper Check, Check 21 | Face-to-face physical check |

| Check 21 | Mailed physical check |

| ACH Debit/Credit | Signed agreement/form |

| Checks by Phone | Payment info over the phone |

| Checks by Web | Payment info over the Internet |

Each program has different rules and requirements that are strictly enforced.

Paya also offers a funding “guarantee” (like insurance) for qualified businesses. More details are available in the Guarantee section below.

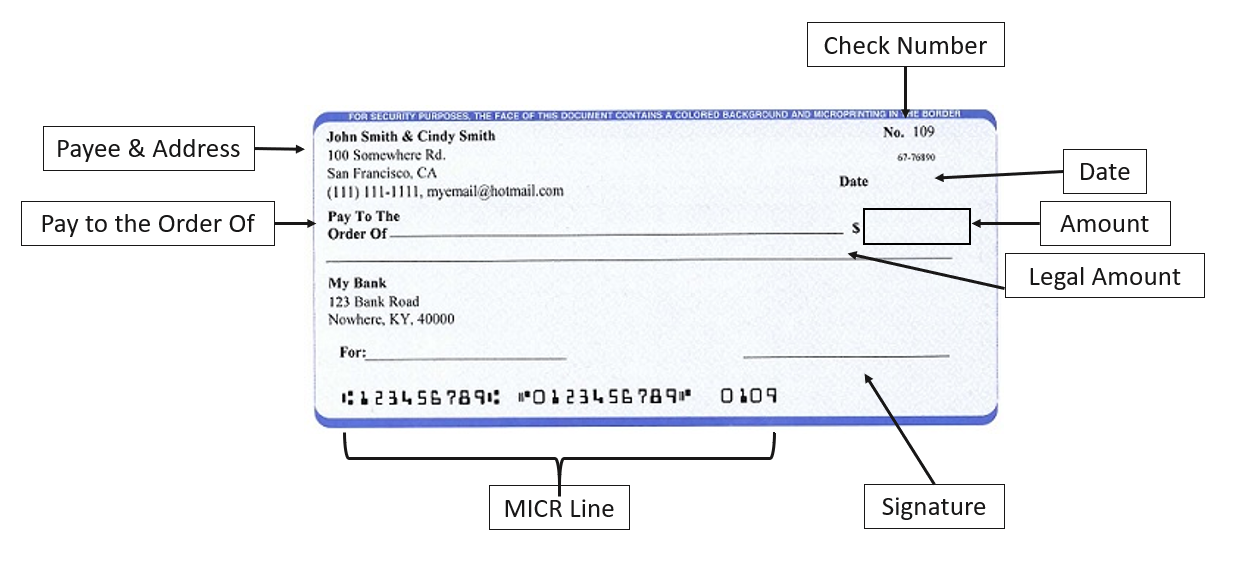

What physical checks can be accepted?

Paya allows personal or business checks to be accepted for the Point of Sale, Paper Check, or Check 21 programs. It is your responsibility to only submit the appropriate types of checks through payment processing.

- Checks must be pre-printed and numbered 101 or higher (not a starter or counter check).

- Do not accept checks that are Line of Credit, Credit Card Convenience, Payroll, 3rd Party, Money Orders, Cashier’s Checks, etc.

- Do not process checks:

- o For cash back

- o That is post-dated

- o Written from employees

- o Multiple checks for one purchase

- o Checks presented from a different person other than the checkwriter

- Checks must be completely filled out by the checkwriter before accepting the check

- Checks must be endorsed by writing/stamping your business name on the back before putting the check through the check reading/imaging equipment

- Checks must have:

- o Pre-printed physical address (if P.O. Box, ask for a physical address, not a counter check)

- o Phone number with area code

- o Driver's license number with the issuing state (document any missing information on the front of the check)

- Checkwriter must be present when running the check through the equipment

- Checkwriter’s driver’s license name and picture must match the person presenting the check

Guarantee

Improve cash flow and eliminate collection operations with a Guarantee. Below are the programs eligible for Guarantee:

- POS Conversion

- ACH Debit (Single Debits Only)

- Paper Check – Paper Guarantee

- Checks by Phone

How does Guarantee work?

While completing a check transaction, the equipment electronically automatically receives verification of the checkwriter’s account history in order to approve and process the debit. Requirements for Guarantee vary by program and can help you avoid risk of non-payment from customers’ returned checks. The Guarantee programs are designed for businesses to keep funds from the payment while Paya handles the collection of the return from the customer. The funds are guaranteed as long as authorization stipulations are met.

Customer claims of fraud, stop payments, and customer fraud are essentially eliminated from funding guarantee and your company will be debited for the return.

Paper Check

Program Details

Non-conversion Guarantee/Non-Guarantee

The verification program allows Paya to “verify” that the customer doesn’t have any outstanding returned checks. Once the check is approved, you can proceed with submitting the check.

- Equipment will give an approval “auth” code or “decline” reason. Document the auth code number on the check and deposit it into your bank account.

- Physical check must be deposited into your bank on the next banking day.

- If you receive a "decline" response from the equipment for any reason, do not attempt to process that check again.

- If you do not already have a Bank Authorization Form (sample here) on file with your bank, complete the form and file it at your bank.

- If any checks are deposited and returned as unpaid by the customer, your bank can mail the checks directly to Paya to begin your Guarantee check claim (only applicable for the Guarantee program.)

- If the customer’s payment returns, please reference the Guarantee section.

Point of Sale Conversion

Program Details

Guarantee/Non-Guarantee

The ACH Conversion program allows Paya to verify that a customer doesn’t have any outstanding returned checks. If the check is approved, Paya processes the check as an ACH transaction and sends you the funds for the check.

How it works:

- Equipment will give an approval “auth” code or “decline” reason and print a receipt.

- If you receive a "decline" response from the equipment for any reason, do not attempt to process that check again.

- If you receive an “approval”, the Electronic Funds Transfer (EFT) receipt will print.

- The EFT must be filled out completely and legibly with the customer’s:

- Full printed name

- Phone number with and area code

- Signature

- EFT receipt should be securely stored and retained for two (2) years from the ACH transaction to the customer’s bank account.

- EFT must be produced within forty-eight (48) hours upon request.

- If you receive a NO-ACH response, the equipment will give an approval “auth” code.

- Document the auth code number on the check and deposit it into your bank account.

- In the event of a NO-ACH response, the physical check must be deposited into your bank on the next banking day.

- In the event of a NO-ACH response and you do not already have a Bank Authorization Form on file with your bank, you must complete the form and take it to be filed at your bank. This ensures that any checks that are deposited and returned as unpaid by your customer, the bank can mail the checks directly to Paya to begin your Guarantee check claim (only applicable for the Guarantee program.)

- If your customer’s payment returns, please reference the Guarantee section.

Check 21

Program Details

Face-to-Face, Guarantee/Non-Guarantee

Check 21 program is where Paya “verifies” that the customer doesn’t have any outstanding returned checks. Once the check is approved, then Paya sends the front and back check images to the customer’s bank and sends you the funds for the check.

- The equipment will give an approval “auth” code or “decline” reason. You need to write the auth code number on the check before storing.

- Do NOT deposit the check unless Paya contacts you and request that you deposit.

- The physical check must be stored by you for a minimum of 90 days and then shredded.

- If your customer’s payment returns, please see the Guarantee section.

Consumer Not Present - Guarantee/Non-Guarantee

The Check 21 program verifies that a Paya customer doesn’t have any outstanding returned checks. Once the check is approved, Paya processes the check image, both front and back, and sends you the funds for the check. Checks received in the mail may be accepted up to two weeks after the date of the check.

See the below tips:

- Equipment will give an approval “auth” code or “decline” reason.

- You need to write the auth code number on the check before storing.

- Do NOT deposit the check unless Paya contacts you and requests you to do so.

- Physical check must be stored by you for a minimum of 90 days and then shredded.

- If the customer payment returns, please see the Guarantee section.

ACH Debit/Credit

Program Details

Customers may authorize a debit to their checking or savings accounts through a written agreement with his or her signature. The ACH Debit program allows debits to an individual or personal bank account using the NACHA Code for Prearranged Payment and Deposit (PPD) or to a business bank account using the NACHA Code for Corporate Credit or Debit (CCD.)

Guarantee/ Non-Guarantee

Single or one-time debit transactions can be processed on a Guarantee program. Recurring debit transactions are only available to be processed on a Non-Guarantee program.

Customer Authorization Requirements:

Clients must retain the customer’s original authorization or copy of the original authorization in its original form that can be reproduced upon request. A sample authorization form can be viewed here. Authorization should be securely stored and retained for two (2) years from the last ACH transaction to the customer’s bank account. You should obtain a copy of a voided check and attach it to the authorization form to ensure proper routing and account number.

Authorizations must be readily identifiable as an authorization containing clear and readily understandable terms (amount and timing).

Prearranged Payment and Deposit (PPD) Requirements:

- Electronic signatures are acceptable if compliant with the National E-Sign Act.

- Details can be found here

- Payment page must provide the customer with a method to revoke the authorization by notifying the business in the manner prescribed within a specified time frame even if processing time does not allow for revocation.

- The following information must be included in the authorization record:

- Consumer Full Name/Business Customer Name

- Consumer/Business Customer Physical Address

- Consumer/Business Customer Banking information

- Transaction Amount

- Transaction Date

- Consumer Signature

- Signify whether authorization is for a single or recurring, multiple debit

- Debit schedule if recurring or multiple

- Authorization verbiage, NSF fee verbiage, applicable terms, and revocation method

- Payment page must display the following authorization verbiage (or substantially similar):

“By signing below, I authorize the Merchant to convert this transaction into an Electronic Funds Transfer transaction or paper draft, and to debit this account for the amount as identified above and to the terms stated here. This authorization shall remain in effect until the Merchant receives written notification from me of intent to terminate at such time and in such manner as to afford the Merchant a reasonable opportunity to act. I authorize this plan to continue as long as the payment amount remains unchanged until the amount owed the Merchant is paid off, or unless the plan is terminated earlier by me as stated above. I understand that all changes such as payment amount, frequency, bank account number change, will require a new ACH Debit Payment Authorization Form to be filled out and submitted to Merchant 15 days prior to any change being implemented.

In the event that I choose to revoke this authorization, I will do so by contacting the merchant directly. Processing times may not allow for revocation of this authorization.

I understand that this payment plan may be cancelled by the Merchant due to NSF (Non-sufficient Funds). In the event this draft or EFT is returned unpaid, I will be liable to pay an NSF fee of $25.00 (or the amount allowable by law), that may be automatically debited to this bank account via draft or EFT for each NSF.”

Corporate Credit or Debit (CCD) Requirements:

- NACHA does not have requirements for a specific format.

- Business consumer has a written agreement (sample available here) with the business originator under which both businesses have agreed to be bound by the ACH Rules.

- Agreement is sometimes referred to as a Trading Partner Agreement.

- Both parties (originator and business consumer) should retain a copy of this agreement.

- Authorization should be securely stored and retained for two (2) years from the last ACH transaction to the customer’s bank account.

- Business customer must provide physical or digital signature.

- Electronic signatures are acceptable if compliant with the National E-Sign Act.

- Details can be found here

- Authorization or agreement must provide the business consumer with the method to revoke his or her authorization by notifying the business originator in the manner prescribed, and the time frame in which the revocation of the authorization must be provided.

- Authorization or agreement must have the following verbiage (or substantially similar):

“Submission of this transaction assumes an agreement is in place between both parties to allow converting this transaction into an Electronic Funds Transfer transaction or paper draft, and to debit this account for the amount of the transaction. Additionally, the agreement further states that in the event this draft or EFT is returned unpaid, a service fee, as allowable by law, will be charged to this account via draft or EFT. In the event you choose to revoke this authorization, please do so by contacting the merchant directly. Please note that processing times may not allow for revocation of this authorization.”

Checks by Phone

Program Details

Checks by Phone allows customers to authorize a debit to their checking or savings bank account over a telephone line. The Checks by Phone program can only be used when there is an existing relationship between a business and consumer, unless in a situation when the consumer initiates the telephone call to the business.

Guarantee/Non-Guarantee

Single or one-time Check by Phone debit transactions can be processed on a Guarantee program. Recurring debit transactions are only available to be processed on a Non-Guarantee program.

Customer Authorization Requirements:

Clients are required to use commercially reasonable methods to authenticate, verify, and validate a customer’s identity prior or during authorization.

Clients must retain the customer’s original authorization or copy of the original authorization in its original form that can be reproduced upon request.

Authorization should be securely stored and retained for two (2) years from the last ACH transaction to the customer’s bank account.

Authorizations must be readily identifiable as an authorization containing clear and readily understandable terms (amount and timing).

Single or one-time debit authorizations must be recorded through one of the following methods:

- Recorded oral authorization

- Provide the consumer with written notice confirming the oral authorization prior to the settlement date of the debit entry

Additional requirements include:

- Authorization or agreement must provide the consumer with the method to revoke his or her authorization by notifying the business in the manner prescribed, and the time frame in which the revocation of the authorization must be provided.

- Authorizations must include the following minimum information as part of the authorization:

- Consumer name

- Account number to be debited

- Date of transaction

- Amount of transaction

- Telephone number that is answered during normal business hours

- Date of oral authorization

- Statement that authorization obtained is for a single ACH debit

- Authorizations must include the following verbiage (or substantially similar) read and captured on the recording and/or written notice:

“(Customer’s First and Last Name), by providing your bank account information and verbal authorization today, (Current Date MM/DD/YY), you <Customer’s Name> are authorizing (Business Name) to create an ACH debit to your account and that this Check by Phone may be drafted from your account as early as today. In the event your Check by Phone is returned from your bank unpaid, you further agree that a fee of $25.00 or as allowable by law shall also be charged to your account via draft or ACH debit.

“Do you authorize (Business Name) to proceed with this Check by Phone? Customer must state “Yes” or “No.”

“A Check by Phone will be drafted from your bank account with the following information (Bank Routing Number, Account Number, Check Number, and Check by Phone Amount). Please allow 12 to 72 business hours for this transaction to post to your account. Should you have any questions regarding your payment, or choose to revoke your authorization, you may reach our office at (Business Telephone that is answered during normal business hours). Be advised that depending on the timing of your scheduled ACH, revocation of the authorization may not be available.”

- Sample Single Authorization Notice:

< Name>,

By providing your bank account information and verbal authorization today <Today>, you have authorized <Business Name> to create an ACH debit to your bank account.

A one-time ACH debit was authorized with the following information

Bank Name <____>

Account Number ending in <____>

Check Number <____>

Amount <____>

Date <_____>

Please allow 12 to 72 business hours for this ACH Debit to post to your account.

Revoking an authorization must be done by calling <Phone Number> by < date.>

Should you have any questions regarding your payment, you may reach our office at <Contact Phone>. The ACH Debit should show on your bank statement as <____ > (Business Name).

Recurring authorizations must be recorded through one of the following methods:

- Recorded oral authorization

- Provide the consumer with written notice confirming the oral authorization prior to the settlement date of the debit entry

Additional requirements include:

- Authorizations must include the following minimum information as part of the authorization:

- Consumer name

- Account number to be debited

- Timing (including start date), number, and frequency

- Amount of the transactions

- Telephone number that is answered during normal business hours

- Date of oral authorization

Checks by Web

Program Details

Bill Pay/E-Commerce

Checks by Web include customers who authorize a debit to their checking or savings account through a website or mobile app (such as a shopping cart).

Bill Pay/E-Commerce Non-Guarantee

Single/one-time and recurring debit transactions are only available to be processed on a Non-Guarantee program.

Customer Authorization Requirements:

Authorizations must be readily identifiable as an authorization containing clear and readily understandable terms (amount and timing).

- Payment page must require the customer to take action to authorize a debit, such as clicking a virtual button, in which the customer acknowledges or agrees to the ACH debit.

- Payment page must provide the customer with a method to revoke the authorization by notifying the business in the manner prescribed, within a specified time frame, even if processing time does not allow for revocation.

- The following information must be included in the authorization record:

- Consumer IP address of origination

- Consumer name

- Consumer email address (optional/industry recommended best practice)

- Consumer address (optional/industry recommended best practice)

- Consumer banking information (Routing Number and Account Number)

- Transaction amount

- Transaction effective date

- Signify whether authorization is for a single or recurring/multiple debit

- Debit schedule if recurring/multiple

- Authorization verbiage, NSF fee verbiage, applicable terms, and revocation method

- Payment page must display the following authorization verbiage (or substantially similar):

“By authorizing this transaction, customer agrees that <merchant name> may convert this transaction into an Electronic Funds Transfer (EFT) via ACH transaction and to debit this bank account for the amount specified. Additionally, in the event this EFT is returned unpaid, a service fee, as allowable by law, will be charged to this account via EFT or ACH. In the event you choose to revoke this authorization, please do so by contacting the <merchant name> directly at <________>. Please note that processing times may not allow for revocation of this authorization.”

- Clients must retain the customer’s original authorization or copy of the original authorization in its original form that can be reproduced upon request.

- Authorization should be securely stored and retained for two (2) years from the last ACH transaction to the customer’s bank account.

- NACHA does not accept the proof of an authorization as being a listing of the information captured at time of authorization.

- Industry best practice for reproduction to appear the same as presented to customer on the website/mobile app at time of authorization to include the following:

- Consumer IP address of origination

- Consumer name

- Consumer email address (optional/industry recommended best practice)

- Consumer address (optional/industry recommended best practice)

- Consumer banking information (Routing Number and Account Number)

- Transaction amount

- Transaction effective date

- Signify whether authorization is for a single or recurring/multiple debit

- Debit schedule if recurring/multiple

- Authorization verbiage, applicable terms, and revocation method

- Website address where payment was accepted

- Statement of how the consumer’s identity was authenticated

Customer Authentication Requirements:

Clients are required to use commercially reasonable methods to authenticate, verify, or validate a customer’s identity prior or during authorization. It is not commercially reasonable to do nothing.

- Assigning password and customer authorizing debit within the same Internet session is not commercially reasonable.

- Possible methods to authenticate are below:

- Shared secrets

- User ID

- PIN

- Password

- Request identifying customer information to verify against outsourced databases.

- Ask challenge questions to verify against credit bureau or outsourced databases.

- Sending the customer specific pieces of information, either physical, online, or offline, and then ask customer to provide that information as a second step in the authentication process.

- Shared secrets

Clients are required to establish and implement a commercially reasonable fraudulent transaction detection system to screen the debit WEB Entry. Such a fraudulent transaction detection system must, at a minimum, validate the customer bank account number:

- At the first use

- For any subsequent change(s) to the account number

NACHA is neutral to specific methods or technologies to validate the customer’s bank account number. It is not commercially reasonable to have done nothing.

- Suggested methods:

- ACH prenotification

- ACH micro-transaction verification

- External validation service

Optional Enhancements

SwiftSettle

Same Day ACH

Paya created the SwiftSettle program in response to the NACHA-developed Same Day ACH product. SwiftSettle is a faster way to process ACH transactions. Clients can initiate ACH credit and debit transactions to settle to the consumer on the same day for time-sensitive payments, such as payroll or refunds. Client funding is not settled on the same day.

- Transactions must be received prior to the established cutoff time.

- Cutoff time is currently 10:00AM CDT

- Only available through gateway and file transmission.

- Must be for an amount of $100,000 or less

- International (IAT) transactions cannot be processed under SwiftSettle, domestic only

Stop Payment Coverage

Certain types of businesses can receive a funding guarantee when the consumer returns a check or ACH as a stop payment through the Stop Payment Coverage program. Clients must receive checks in a face-to-face environment and have one of the products below:

- POS Conversion Guarantee – conversion of checks with funding guarantee

- Paper Guarantee – manual deposit of checks with funding guarantee

- Check 21+ POS Guarantee – transmission of checks via check image with funding guarantee

Client shall have performed all of its obligations related to the issuance of the check.

On the POS Conversion Guarantee and Check 21+ POS Guarantee the client is required to have a check imager for to qualify for stop payment coverage. In addition, stop payment claims require a copy of the invoice/work order, and an image of the check along with written information regarding any claims for reimbursement. Service or product must have been delivered to consumer.

On the Paper Guarantee the client is required to provide a copy of the invoice/work order and the original check along with written information regarding any claims for reimbursement. Claims must be submitted within 30 days from the date of the original transaction. Service or product must have been delivered to check writer.

Important notes:

- Stop Payment Coverage is only applicable on eligible ACH items.

- Stop payment returns will automatically be debited from the client’s account until the claim is investigated by Paya Services.

- Accepted claims will be paid within 30 days.

- Stop Payment Coverage requires the client to pay additional .25% discount rate per transaction.

Stop payment coverage is designed for the following types of clients:

- Auto Glass Install/ Repair

- Auto Repair

- Boat Repair

- Motorcycle Repair

- Motorhome Repair

- Paint and Body Repair

- Transmission Repair

Consumer Convenience Fees

Paya offers a Consumer Convenience Fee (CCF) program, which is a no-fee check processing service. CCF gives clients the opportunity to pass processing costs to the consumer, resulting in no-fee for ACH transaction processing.

Clients benefit from added secure payment method without increased cost as there are no processing fees or annual fees for clients. Clients receive online reporting to track transactions at no added cost.

Ideal client types are the following types of clients:

- Federal/State/Local Government offices

- Municipalities

- Nonprofit/Charity Organizations

- Fundraisers

- Bill Pay payment gateways

- Educational

Options are Compatible with the following programs

- ACH Debit

- Checks-by-Phone

- Checks-By-Web

- Non-Guarantee programs only

Check Verification Services

Paya provides three different levels of consumer bank account verification or identity validation through third-party vendors. Paya’s verification features assist in reducing overall Paya and/or Client loss by declining to process check and ACH transactions to bank accounts that may be more likely to return.

Level One: Nationwide Proprietary Database

- Thousands of organizations nationwide participate in contributing data to a third-party vendor database that tracks consumers by checking account number and driver’s license number. The database uses the check and ACH transaction information to verify if a consumer has outstanding bad checks within the participating clients and/or check collection companies.

- A consumer with prior returned check or ACH transactions associated with their bank account or driver’s license will be declined from processing.

This database verification enables Paya to customize velocity limits for consumer transactions. Each velocity limit only approves a specific number of checks with a total combined amount per consumer within a specific window.

Level Two: Advanced Account Validation

- Paya uses a third-party vendor to complete a real-time verification of a checking or saving for the account status. The Advanced Banking Verification checks if a consumer’s bank account is open and has a minimum of $1.00 balance.

How does the verification work?

- Consumers’ financial institution report to the third-party vendor on the status of their customers’ bank accounts at the end of the prior day’s processing cycle.

- When Paya receives a transaction for verification, the data is passed to the vendor seamlessly in real-time.

- The vendor will check the status from the financial institution and respond as “approve” or “decline” based on the status.

What causes a decline?

- Bank account doesn’t match an active bank account

- Bank account has recent negative history of insufficient funds returns

- Bank account matches a closed or negative account.

Items of note:

- An approved transaction can still return because changes can happen to a bank account between the verification and presentation.

- Not all banks participate, approximately 75% to 80% participation.

- If the bank account number is for a non-participating bank, then the transaction will be approved but, the transaction can still return.

Level Three: Identity Verification

- Paya uses a third-party vendor to complete a real-time, seamless authentication of a consumer’s identity using the following consumer information that is collected and entered into a check or ACH transaction.

- Name

- Address

- Date of birth

- Social Security Number

Money Laundering

More Details

You can only deposit transactions for your own business. Depositing transactions for a business that does not have a valid processing agreement is called laundering or factoring. Laundering is a form of fraud associated with high chargeback rates and the potential for forcing clients out of business. General Information around Money Laundering can be found here.

Fraudulent or Suspicious Transactions

More Details

We ask our clients to always be on the lookout for possible fraud. Below are some tips that may help spot a bad check writer.

- Valid checks should always have the following:

- Perforated edge as checks are made in sheets or books separated by perforations

- Check number should always be at the top right-hand side of the check

- Check numbers should be sequential and should change from check to check

- Checks with numbers less than 200 should be refused or taken with caution

- Customer’s name and address should be pre-printed, and the fonts should be identical

- Look for erasures or alterations on checks

- There should not be any staining or discolorations on the face of the check

- Bottom of the check should contain MICR encoding

- Inspect that the check is signed by the person who is listed as the account holder.

- If the appearance of the check being presented or the behavior of the person presenting the check is suspicious in nature, consider not accepting a check for payment.

- The ID the customer presents should correspond to the person in front of you. If the date of birth does not seem appropriate or the picture does not appear to be of the same person making the purchase, the check should be refused immediately before a transaction is attempted.

If you have any question about the legitimacy of your customer or the check presented to you, we urge you to carefully consider not taking the check. Remember, clients can help us to continue to keep our product costs low by always being on the lookout for possible fraud.

If you are ever unsure of how to handle a check or unusual transaction, please consult with a knowledgeable Paya support agent. Please also refer to your terminal guide, where you will find many helpful “Quick-tips”.

Customer Transaction Disputes

More Details

Businesses that have used credit card processing are familiar with the term “chargeback”. A chargeback is when a customer disputes a credit card payment. Federal banking laws and NACHA Operating Rules & Guidelines allow customer disputes to protect consumers.

Paya uses similar terminology for ACH and check. A client receives a “chargeback” after a checkwriter’s return is received from an ACH debit or Check 21 transaction when the client previously received funding from Paya and one of the following has occurred:

- Client does not have a funding Guarantee service

- Paya has removed the funding Guarantee

Federal banking laws and NACHA have specific guidelines and rules for all parts of transaction processing, including returning transactions or checks that may or may not originate from a customer’s dispute. Not all returns are from disputes. A list of the return codes is available in your online reporting.

- Decisions to return a transaction are made by the customer or account holder’s bank.

- Decisions to accept a return are made by the bank that processed the transaction.

The customer’s bank can only send a return for specific reasons and for specific time frames. When returning a transaction, the customer’s bank will place funds back in the bank account, similar to a refund. Then the customer’s bank sends a return through the Federal Reserve or ACH Network to the bank that processed the transaction. The customer’s bank assigns a return code to indicate the reason for the return.

A customer can dispute a transaction through their bank when he or she believes that they did not authorize for a business to send the debit. Paya Services, and therefore the client, is not always afforded the right to disprove a customer or account holder’s dispute. Customer disputes are allowed at any time.

Before the 61st calendar day from the settlement date of a transaction, the customer’s bank is allowed to return a transaction based only on the customer’s claim when the following is met:

- Account holder signs a Written Statement of Unauthorized Debit (WSUD)

- Claim and return are before the 61st calendar day from the settlement of a debit

Please be aware that the customer’s bank is not required to send notice, documentation, etc. to the processing bank. The processing bank is required to accept the return when it meets the defined criteria and time frame.

After the 61st calendar day to two (2) years from the settlement date, the customer’s bank must receive permission from the processing bank to send a return of an ACH transaction. The customer’s bank can only return a transaction after the following is met:

- Account holder signs a WSUD

- Customer’s bank has requested the proof of authorization prior from processing bank

- Required to wait 10 calendar days for reply

- Processing bank requests the Paya to provide proof of authorization within enough time for processing bank to supply to customer’s bank

- Paya requests the proof of authorization from originating client

- If the proof of authorization is not provided, then the customer’s bank is allowed to return the ACH transaction(s)

- If the proof of authorization was provided and customer’s bank believes that ACH transaction(s) was fraudulently authorized by someone not on the account, then the customer’s bank will be allowed to return the debit(s)

- If the proof of authorization was provided and the customer’s bank believes that the authorization was not obtained in compliance with NACHA rules, then the customer’s bank will be allowed to return the debit(s)

Expedited Processor Returns

More Details

E-Code Returns

The Expedited Processor Returns were created and implemented as a requirement of Paya’s processing bank to comply with the NACHA Operating Rules.

Clients are not allowed to process transactions to bank accounts in which they have received a previous return code other than insufficient funds and/or uncollected funds. To do so, could be a NACHA Rules Violation.

A transaction that was previously returned can only be re-attempted or re-sent if:

- Transaction(s) returned for insufficient (R01) or uncollected funds (R09);

- Transaction(s) returned for stopped payment and re-initiation has been authorized by the Receiver in a new authorization

- Corrective action to remedy the reason for the return, such as a typo

A transaction that was previously returned can only be re-attempted or resent within one hundred eighty (180) days after the settlement date of the original attempt.

A transaction that was previously returned can only be re-attempted or re-sent if it has not been returned for insufficient or uncollected funds more than two times following the first return.

Paya is required to enforce restrictions on the types of ACH transaction that may be originated. Paya strives to protect clients from NACHA Rules Violations. Therefore, Paya developed the Expedited Processor Returns to stop a client from processing transactions that could be considered in violation to the NACHA Operating Rules.

Paya labels Expedited Processor returns with an E-Code instead of an R-Code to provide clients the ability to differentiate between the standard “Receiving Bank” initiated returns (R-Code) and “Processor” initiated returns (E-Code).

The E-Codes are designed based on the customer or account holder and what Paya expects his/her bank to do based on a transaction the bank previously returned. Meaning that Paya expects the bank to return more transactions using the same return code after first returning one transaction. The E-Codes are used for Check 21 transactions, as well as ACH transactions for consistency along product lines. An additional benefit of E-Code Returns for a client is the acceleration of returns to be received in one business day from three business days to for these types of returns.

Examples:

- If a customer’s account was closed/invalid/not located yesterday, there is minimal likelihood that the account will be open today.

- If a customer did not allow client ABC to debit his/ her account yesterday, there is minimal likelihood that he/she will allow client ABC to debit today.

- If a customer allowed client XYZ to debit his/her account yesterday but did not client ABC (their debit returned R10), this will not affect transactions for client XYZ.

The E-Code feature is not an overall opt-in/ opt-out feature. An E-Code block can be removed from a customer’s bank account once the client that processed the transaction provides a letter from the customer’s bank on bank letterhead that states that the bank account is active and/or the stop payment has been removed. For more details contact your payment provider.

Transaction Returns

More Details

NACHA calculates returns on a rolling the sixty (60) day period and each submission counts individually. Return rates do not include reversals, credits, refunds, or Expedited (E-Code) Returns.

NACHA shows two ways to calculate the return rates. Paya calculates the return rated by dividing the number of debit transactions returned for the preceding sixty (60) days by the total number of debit transactions contained within the files in which the original transactions were processed. Return rates are used for Check 21 transactions, as well as ACH transactions for consistency along product lines.

Below are the NACHA return rates that are allowed for a 60-day period.

- Overall Returns less than 15%

- Unauthorized Returns (R05/R07/R10/R29/R51) less than 0.5%

- Admin Returns (R02/R03/R04) less than 3%

Example:

Client processes 100 transactions within 60 days and 10 of these transactions returned with the following return codes.

- 6 @ R01 and R09

- 3 @ R02, R03, and R04

- 1 @ R10

The return rates would be as follows:

- Overall Returns as 10/100 = 10% = Below NACHA limit

- Unauthorized Returns as 1/100 = 1% = Over NACHA limit

- Admin Returns as 3/100 = 3% = At NACHA limit

Transaction Return Tips

Paya’s goal is to provide guidance that will assist you in maintaining a return rates below the NACHA acceptable limits and help you prevent future returns from debits you process to your customers.

Some of the most common fatal return codes are below:

- R02/E02 - Closed Account

- R03/E03 - No Account/Unable to Locate

- R04/E04 - Invalid Account Number

- R05/E05 - Unauthorized Debit to a Consumer Account Using Corporate SEC Code

- R07/E07 - Authorization Revoked by Customer

- R08/E08 - Payment Stopped

- R10/E10 - Customer Advises Originator Not Known and/or Not Authorized to Debit Account

- R11/E11 - Customer Advises Not in Accordance with Authorization

- R13/E13 - RDFI Not Qualified to Participate

- R14/E14 - Representative Payee Deceased or Unable to Continue in that Capacity

- R16/E16 - Frozen Account

- R20/E20 - Non-Transaction Account

- R29/E29 - Corp Customer Advises Not Authorized

When you receive a return other than R01 or R09 you or your customer are required to act before you can process a new debit to the same bank account. Continuing to attempt debits to the same bank account that has a return code other than R01 or R09 will most likely result in more returns and may result in a NACHA Rule Violation, which we want to help you avoid. Make a point to remove recurring customers from the next billing cycle when you receive a return with any return code other than R01 or R09.

Returns from your customer with a return code as R05, R10, or R29 may indicate that the customer is required to notify their bank to provide authorization with the bank in order to accept a debit from you. The customer’s bank will need our Company ID number, which is within the details that we send with the transaction. You can receive our Company ID# by contacting us. You can provide this number to your customer(s) and request that the customer notify his or her bank to allow the ACH payments to process without being returned.

If you have questions or require additional information, please contact us and we will be in touch with you shortly.